The market was undervalued for a New York minute in March 2020. This brief period in March ultimately proved a great buying opportunity (we began scooping up stocks two days after the March low), and the sharp stock market recovery amid COVID lockdowns and negative earnings growth yet again created a broadly overvalued environment for stocks. As a result, using current figures, return expectations at present are less than sanguine. The effect is most pronounced among many large US companies, suggesting a 10-year annualized return expectation for US large caps of only 4%. This is prompting us to currently underweight this area of the market.

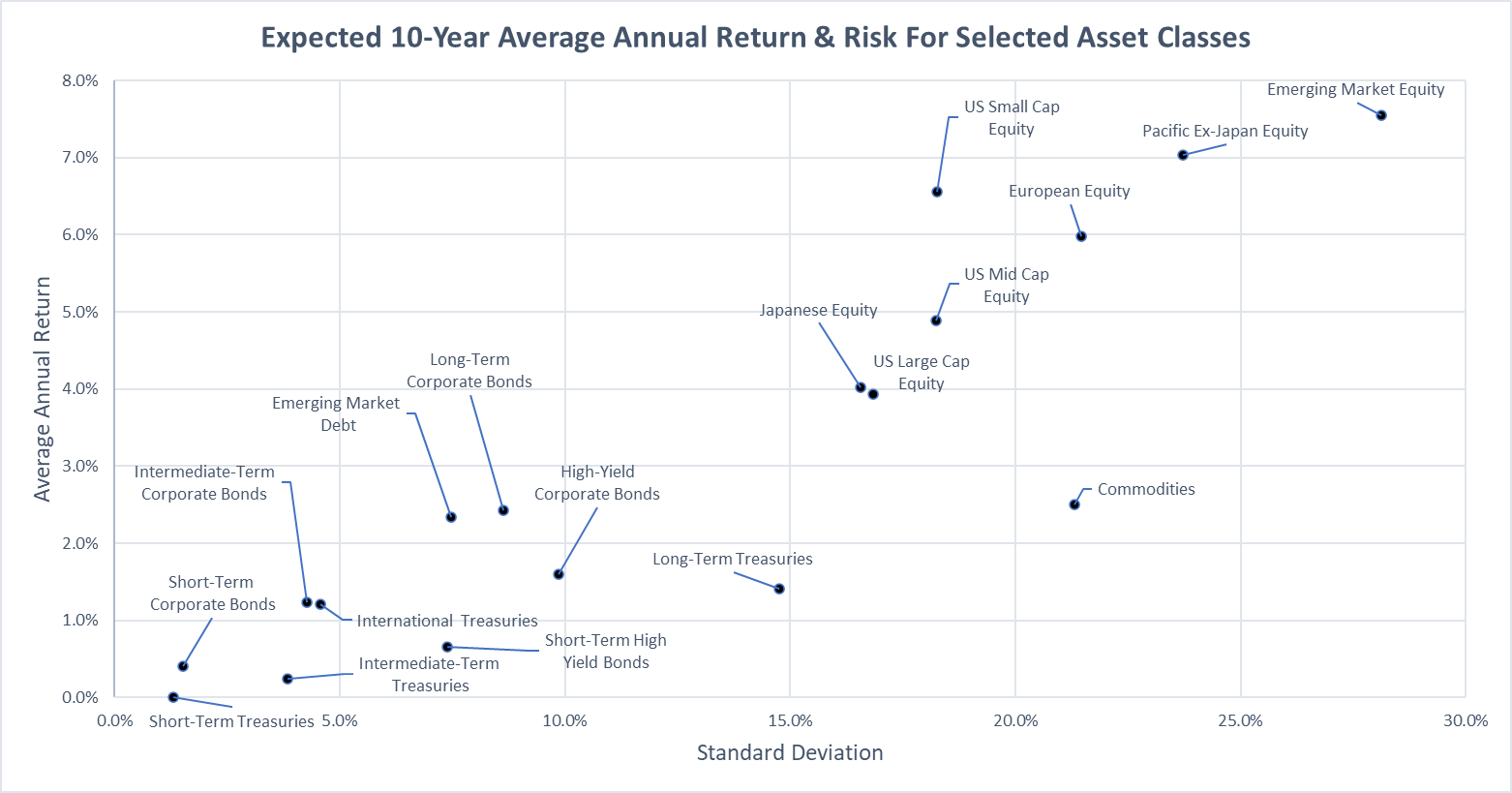

These are our ten-year return forecasts by asset class as of January 1, 2021. Note that the higher an asset class is on the y-axis, the greater its expected annual return, while the volatility (risk) of an asset class increases as it moves right along the x-axis.

There is a possibility, and in our opinion a strong one, that the current overvaluation could be tempered in the future. Many companies are still hurting from COVID-related shutdowns and business disruptions, and it is reasonable to expect the earnings of these companies to pick up as business conditions normalize in 2021.

The uncertainty is whether earnings will increase to the point where today’s equity overvaluations are completely resolved. If future earnings growth disappoints, further progress in the current equity rally could be stymied.

Due to Overvaluation, a Rotation in Leadership Seems Likely

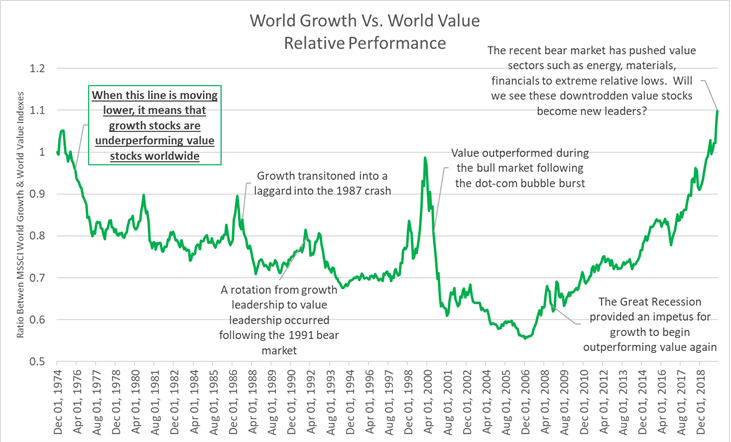

Historically, bear markets and recessions have often coincided with major turning points in market leadership. I created the chart below during the thralls of last year’s bear market to explain this. “Growth” stocks, whose earnings and earnings growth tend to be largely consistent in all market cycles, will typically alternate leadership with “value” stocks, or stocks of companies whose earnings are very sensitive to changes in the economy. Growth has performed exceptionally well since 2008, led by big technology companies, while value sectors (energy, financials, materials) have fared relatively poorly. Based on how expensive many growth stocks have become relative to value stocks, a rotation out of big technology leadership during 2021 appears likely.

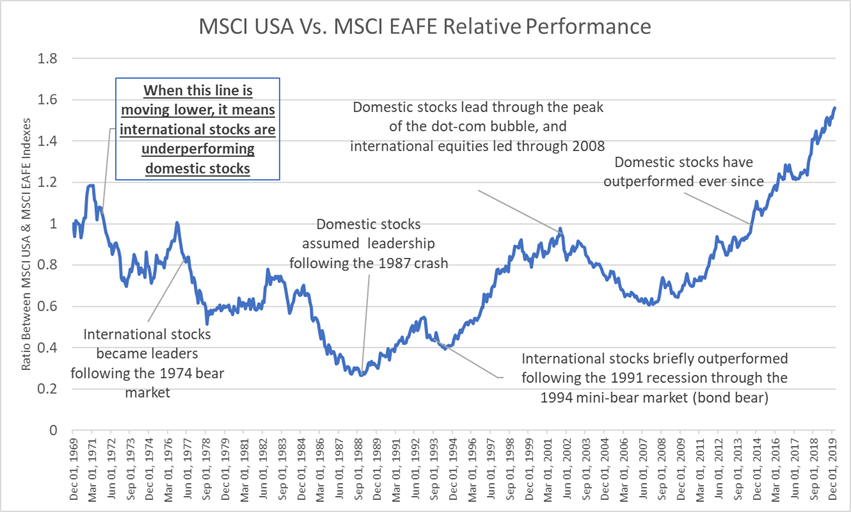

Similarly, leadership often alternates between domestic and international stocks following a bear market. If one looks at the composition of domestic stock indices such as the S&P 500, they are heavily weighted toward technology companies. International market indices are much more weighted toward financials and industrial companies. Taking note of historical trends and a plethora of evidence suggesting international stocks are at bargain prices relative to domestic stocks, 2021 could be a strong year for international markets.

For anyone wondering, “EAFE” stands for Europe, Asia and Far East, while “MSCI” is just a stock index provider.

Low Expected Bond Returns – So Why the Heck Own Them?

When I was in school, my professors taught that the primary reason for owning bonds is for their predictable interest payments. This viewpoint has become less and less relevant, as 10-year Treasury bond rates fell from above 6% in the 1990s to about 4% in the first decade of the 2000s to today’s whopping 1.09%. Some of the reasons rates dropped to such a low level include massive monetary stimulus from the Federal Reserve and historically low inflation and perceived threat of future inflation.

Many investors are responding to this frustrating low-rate environment by throwing their hands in the air and exclaiming, “Why own bonds at all?” We would argue that the best benefit of bonds is not their income, but their risk-lowering benefits as a result of diversification. In other words, investment-grade bonds tend to move inversely to stocks during bad markets (like March of last year). To wit, a 60% stock/40% Treasury bond portfolio fell about 16% from the Feb 2020 market peak to its trough a month later. A 60% stock portfolio with no bonds fell closer to 21%. There are few, if any, other instruments that help smooth portfolio returns to the same degree as high-quality bonds.

In addition to smoothing out returns, bonds reduce “sequence of return risk” by providing a stable investment which can easily be converted to cash during bad times. If you, like us, believe that stocks rise over the long term, you do not want to be selling your stocks during short-term depressed markets – that’s the last thing you want. So instead, bond holdings can be used to fulfill cash needs as necessary.

Final Thoughts – Despite Lower Expected Returns, Stocks & Bonds Still Largely the Best Games in Town

We construct our portfolios and investment strategies by choosing the asset classes expected to produce the best risk/reward ratios. And, even though expected long-run returns across the spectrum are below average going into 2021, stocks appear to be the most attractive investment for capital growth, while bonds are the best for modest interest income and diversification.

Other asset classes fall somewhat short. Direct real estate investing may be appropriate for larger investors but runs into the issue of sizable transaction costs and illiquidity. Bitcoin and currencies fall flat because, even though they may be good short-term trading instruments, their lack of cash flow production quenches long-run expected returns. And many commodities face high carry/storage costs (oil and agricultural goods) and/or the issue of no cash flow creation.

Therefore, our portfolios in 2021 will be generally composed of stocks and bonds and focused on maximizing returns while minimizing risk. And although we have no reason to currently expect volatility reminiscent of 2020, we continue to closely monitor our proprietary systems for any signs of market weakness and will be ready to take action to preserve capital if necessary.

Welcome 2021 – Let’s Kick Off the Year With All-Time Highs & Overvaluation

The market was undervalued for a New York minute in March 2020. This brief period in March ultimately proved a great buying opportunity (we began scooping up stocks two days after the March low), and the sharp stock market recovery amid COVID lockdowns and negative earnings growth yet again created a broadly overvalued environment for stocks. As a result, using current figures, return expectations at present are less than sanguine. The effect is most pronounced among many large US companies, suggesting a 10-year annualized return expectation for US large caps of only 4%. This is prompting us to currently underweight this area of the market.

These are our ten-year return forecasts by asset class as of January 1, 2021. Note that the higher an asset class is on the y-axis, the greater its expected annual return, while the volatility (risk) of an asset class increases as it moves right along the x-axis.

There is a possibility, and in our opinion a strong one, that the current overvaluation could be tempered in the future. Many companies are still hurting from COVID-related shutdowns and business disruptions, and it is reasonable to expect the earnings of these companies to pick up as business conditions normalize in 2021.

The uncertainty is whether earnings will increase to the point where today’s equity overvaluations are completely resolved. If future earnings growth disappoints, further progress in the current equity rally could be stymied.

Due to Overvaluation, a Rotation in Leadership Seems Likely

Historically, bear markets and recessions have often coincided with major turning points in market leadership. I created the chart below during the thralls of last year’s bear market to explain this. “Growth” stocks, whose earnings and earnings growth tend to be largely consistent in all market cycles, will typically alternate leadership with “value” stocks, or stocks of companies whose earnings are very sensitive to changes in the economy. Growth has performed exceptionally well since 2008, led by big technology companies, while value sectors (energy, financials, materials) have fared relatively poorly. Based on how expensive many growth stocks have become relative to value stocks, a rotation out of big technology leadership during 2021 appears likely.

Similarly, leadership often alternates between domestic and international stocks following a bear market. If one looks at the composition of domestic stock indices such as the S&P 500, they are heavily weighted toward technology companies. International market indices are much more weighted toward financials and industrial companies. Taking note of historical trends and a plethora of evidence suggesting international stocks are at bargain prices relative to domestic stocks, 2021 could be a strong year for international markets.

For anyone wondering, “EAFE” stands for Europe, Asia and Far East, while “MSCI” is just a stock index provider.

Low Expected Bond Returns – So Why the Heck Own Them?

When I was in school, my professors taught that the primary reason for owning bonds is for their predictable interest payments. This viewpoint has become less and less relevant, as 10-year Treasury bond rates fell from above 6% in the 1990s to about 4% in the first decade of the 2000s to today’s whopping 1.09%. Some of the reasons rates dropped to such a low level include massive monetary stimulus from the Federal Reserve and historically low inflation and perceived threat of future inflation.

Many investors are responding to this frustrating low-rate environment by throwing their hands in the air and exclaiming, “Why own bonds at all?” We would argue that the best benefit of bonds is not their income, but their risk-lowering benefits as a result of diversification. In other words, investment-grade bonds tend to move inversely to stocks during bad markets (like March of last year). To wit, a 60% stock/40% Treasury bond portfolio fell about 16% from the Feb 2020 market peak to its trough a month later. A 60% stock portfolio with no bonds fell closer to 21%. There are few, if any, other instruments that help smooth portfolio returns to the same degree as high-quality bonds.

In addition to smoothing out returns, bonds reduce “sequence of return risk” by providing a stable investment which can easily be converted to cash during bad times. If you, like us, believe that stocks rise over the long term, you do not want to be selling your stocks during short-term depressed markets – that’s the last thing you want. So instead, bond holdings can be used to fulfill cash needs as necessary.

Final Thoughts – Despite Lower Expected Returns, Stocks & Bonds Still Largely the Best Games in Town

We construct our portfolios and investment strategies by choosing the asset classes expected to produce the best risk/reward ratios. And, even though expected long-run returns across the spectrum are below average going into 2021, stocks appear to be the most attractive investment for capital growth, while bonds are the best for modest interest income and diversification.

Other asset classes fall somewhat short. Direct real estate investing may be appropriate for larger investors but runs into the issue of sizable transaction costs and illiquidity. Bitcoin and currencies fall flat because, even though they may be good short-term trading instruments, their lack of cash flow production quenches long-run expected returns. And many commodities face high carry/storage costs (oil and agricultural goods) and/or the issue of no cash flow creation.

Therefore, our portfolios in 2021 will be generally composed of stocks and bonds and focused on maximizing returns while minimizing risk. And although we have no reason to currently expect volatility reminiscent of 2020, we continue to closely monitor our proprietary systems for any signs of market weakness and will be ready to take action to preserve capital if necessary.

Join Our Mailing List