Forging a Path Back to More Normalcy

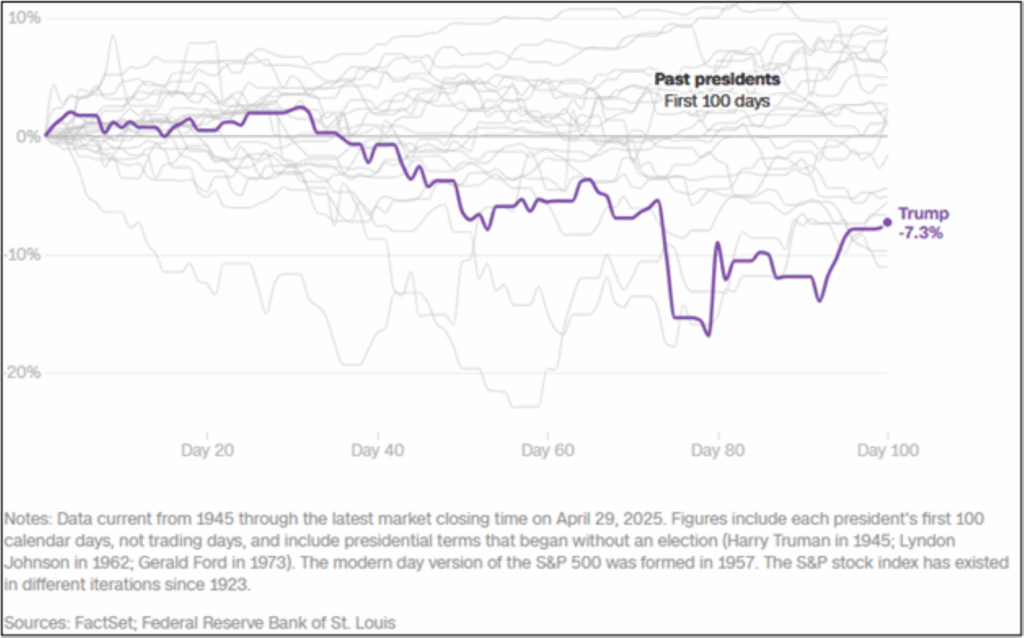

The second quarter of 2025 kicked off with market turbulence, as the so-called “tariff tantrum” sent the S&P 500 tumbling more than 10% in the first week of April. Although markets rebounded following President Trump’s announcement of tariff relief, the early volatility through April marked one of the worst starts for equities during the “first 100 days” of a new presidency since 1945, according to CNN.

From then on, however, markets recovered, and domestic stocks are now in the green year-to-date, posting low single-digit gains. International markets and especially Europe are the stars in 2025 thus far, with the MSCI EAFE Index up just over 15% and the MSCI European Monetary Union Index up nearly 25% (yCharts).

Tariff Talk Tapers, and Markets Approve

Our April commentary cited sharply increasing lending market stress, tightening financial conditions, and deteriorating supply chains as evidence that recession risk was increasing and would likely continue unless tariffs were reduced or paused. This reduction came on April 9 as staggering “reciprocal tariffs” were replaced for most countries with flat 10% tariffs for 90 days. Both markets and economic data have responded favorably to the policy change, and recession risk has substantially decreased.

Our current outlook is that global economic growth will continue this year, and inflation will continue to moderate. In the US, Trump’s “Big, Beautiful Bill” is set to permanently extend the individual tax rates introduced in the 2017 Tax Cuts and Jobs Act, make overtime pay and tips nontaxable through 2028, and then introduce a special $4,000 tax deduction for seniors through 2028 as well (Congress.gov). We expect the bill to slightly stimulate the economy, but it will add $3 trillion to the federal debt through 2034, according to the Congressional Budget Office. The increased deficit spending may cause longer-term bond yields to remain elevated as investors wrestle with the risk–reward tradeoffs of owning long-term US Treasuries.

Uncertainty Still Prevalent & Businesses Are Still Anxious

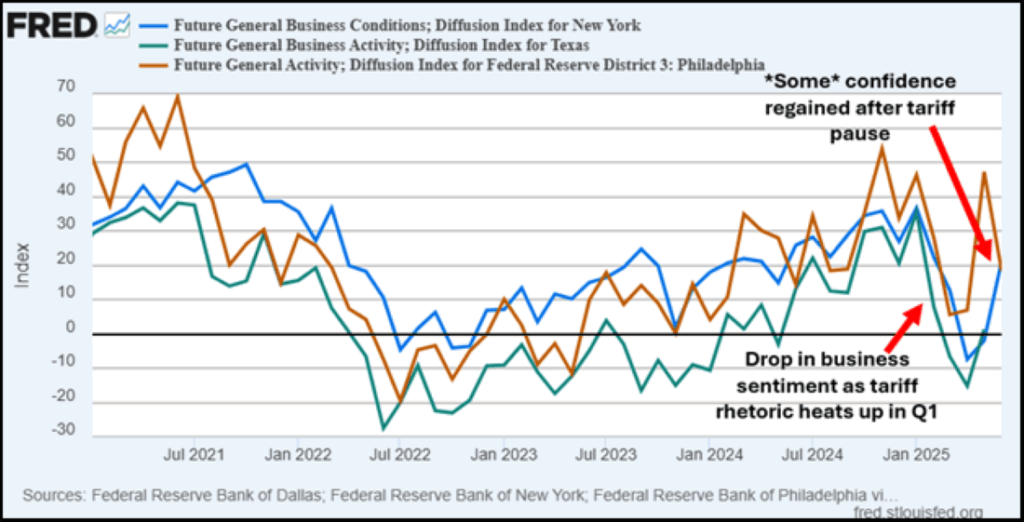

In our previous commentary, we indicated that the uncertainty surrounding tariff policies could be just as damaging as tariffs themselves. Business confidence plunged through March of this year, with regional surveys conducted by the Federal Reserve indicating growing pessimism surrounding future business activity. Since the April 9 tariff pause for most countries, confidence has rebounded but generally isn’t back to pre-trade war levels yet. This suggests continued uncertainty surrounding economic/trade policy and business conditions.

Source: Federal Reserve

Data from the Institute of Supply Chain Management’s monthly business outlook surveys corroborate the continued uncertainty in the business environment. Some notable replies from the May ISM surveys included:

Manufacturing survey:

- “We have entered the waiting portion of the wait and see, it seems. Business activity is slower and smaller this month. Chaos does not bode well for anyone, especially when it impacts pricing.”

- “Tariff uncertainty is impacting new international orders. Tariffs are also the main reason our Asia customers are requesting delayed shipments.”

Services survey:

- “Tariffs have increased the cost of doing business. It’s too early to tell what the lasting impact of this will be.”

- “Tariffs remain a challenge, as it is not clear what duties apply. The best plan is still to delay decisions to purchase where possible.”

Our opinion is that the sooner Trump can put tariff rhetoric to bed, the better, especially as we approach July 9, the end date for the 90-day tariff pause/reductions. After this date, country-specific tariffs of up to 50% are supposed to be reinstated (WhiteHouse.gov), with many emerging market economies facing the highest potential tariff rates. It’s our opinion that Trump will either extend the current tariff pause or only implement a greatly reduced tariff schedule so as not to spook markets again. On balance, this could be positive for the long-term performance of markets and the economy and could be a good step toward rebuilding business confidence.

War in the Middle East & Market Impacts

Beyond tariffs, markets are focused on other geopolitical risks, namely the evolving conflict between Israel and Iran. Initially, it looked as if fighting would be confined between Israel and Iran, but then the US jumped in and bombed several uranium refinement facilities. Russia and China, which are Iran’s most powerful allies, have thus far condemned the attack but urged peace and have not indicated a willingness to send in their own militaries to intervene.

The threat of further escalation currently appears diminished, and a sustainable ceasefire may be possible, but many are still asking what would happen to markets if events took an unexpected turn for the worse and a larger war (proxy or otherwise) broke out. If history is any guide, the market reaction could be muted beyond the short term. The chart below, courtesy of First Trust, illustrates the performance of the S&P 500 from 1928 through February 2022, with dates of significant wars highlighted throughout.

Source: First Trust

Some wars were followed by market rallies, while others were followed by declines. This leads us to the opinion that prevailing economic and market conditions prior to a war often supersede the conflict itself. For instance, the Iraq War started in 2003 just as the early 2000s recession was ending. Stocks were beaten down and undervalued, and interest rates were at 50-year lows thanks to an accommodative Federal Reserve. Sure, there was some short-term volatility as the war started, but the market ultimately rallied over the next several years. How much did the start of the Iraq War have to do with the initiation of the 2003–2007 multiyear bull market? Probably not much.

Fast-forward to now, and the economy is still growing, unemployment is low, and Congress is trying to pass fiscal stimulus. That suggests that escalation of the current conflict could temporarily stir up equity and oil markets, but the impacts will likely fall far short of quenching the bull market and economic expansion.

Final Thoughts – What We’re Watching for in Q3

Current economic and market data suggest an optimistic outlook for investments through the second half of 2025. The economy is normalizing, although there is always a risk that trade wars will heat up again. At the same time, inflation continues to trend lower towards the Fed’s long-term 2% target (Bureau of Labor Statistics), leading us to believe that short-term interest rates will be cut in September. Futures markets and the Fed’s own projections are implying there will be a second rate cut prior to year-end, most likely in December (CME Group).

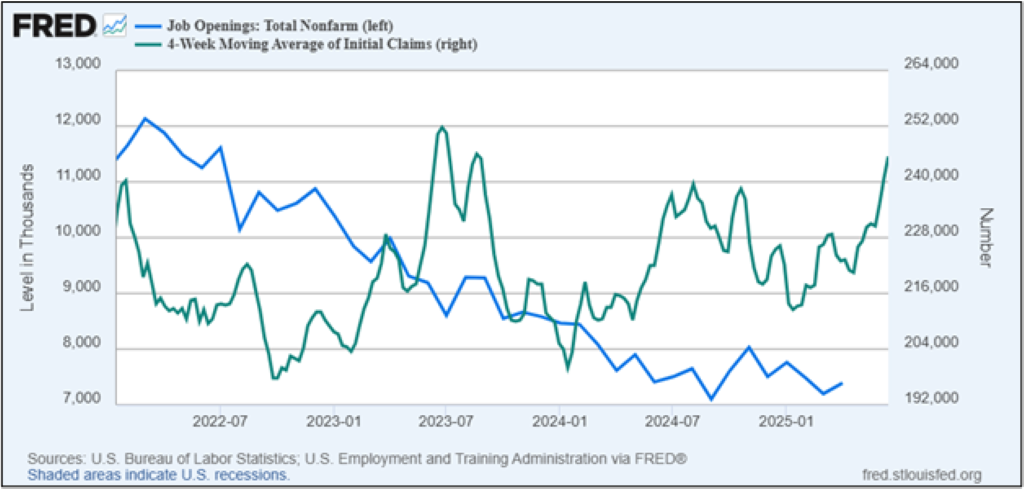

Indicators we’ll be especially watching include business confidence data and statistics on the health of the labor market. Job openings are gradually falling, and weekly claims for unemployment benefits are edging higher. This doesn’t concern us so long as conditions do not rapidly deteriorate, as the Federal Reserve is still trying to bring the labor market into better balance.

Source: Federal Reserve

On a very near-term basis, the S&P 500 is approaching its February all-time high at 6,144 (yCharts). At the same time, the percentage of individual stocks in short-term uptrends is decreasing, indicating selective strength in recent rallies (StockCharts). These conditions often lead to short-term market pullbacks, so gains may pause over the coming weeks. Regardless, we are positive on stocks and the economy over the longer term, so any minor dip should likely be viewed as a buying opportunity.

As always, we are grateful for the opportunity to serve you in your wealth-building journey, and on behalf of Union Bridge Capital, we wish you a wonderful summer.

Second Quarter 2025 Commentary

Forging a Path Back to More Normalcy

The second quarter of 2025 kicked off with market turbulence, as the so-called “tariff tantrum” sent the S&P 500 tumbling more than 10% in the first week of April. Although markets rebounded following President Trump’s announcement of tariff relief, the early volatility through April marked one of the worst starts for equities during the “first 100 days” of a new presidency since 1945, according to CNN.

From then on, however, markets recovered, and domestic stocks are now in the green year-to-date, posting low single-digit gains. International markets and especially Europe are the stars in 2025 thus far, with the MSCI EAFE Index up just over 15% and the MSCI European Monetary Union Index up nearly 25% (yCharts).

Tariff Talk Tapers, and Markets Approve

Our April commentary cited sharply increasing lending market stress, tightening financial conditions, and deteriorating supply chains as evidence that recession risk was increasing and would likely continue unless tariffs were reduced or paused. This reduction came on April 9 as staggering “reciprocal tariffs” were replaced for most countries with flat 10% tariffs for 90 days. Both markets and economic data have responded favorably to the policy change, and recession risk has substantially decreased.

Our current outlook is that global economic growth will continue this year, and inflation will continue to moderate. In the US, Trump’s “Big, Beautiful Bill” is set to permanently extend the individual tax rates introduced in the 2017 Tax Cuts and Jobs Act, make overtime pay and tips nontaxable through 2028, and then introduce a special $4,000 tax deduction for seniors through 2028 as well (Congress.gov). We expect the bill to slightly stimulate the economy, but it will add $3 trillion to the federal debt through 2034, according to the Congressional Budget Office. The increased deficit spending may cause longer-term bond yields to remain elevated as investors wrestle with the risk–reward tradeoffs of owning long-term US Treasuries.

Uncertainty Still Prevalent & Businesses Are Still Anxious

In our previous commentary, we indicated that the uncertainty surrounding tariff policies could be just as damaging as tariffs themselves. Business confidence plunged through March of this year, with regional surveys conducted by the Federal Reserve indicating growing pessimism surrounding future business activity. Since the April 9 tariff pause for most countries, confidence has rebounded but generally isn’t back to pre-trade war levels yet. This suggests continued uncertainty surrounding economic/trade policy and business conditions.

Source: Federal Reserve

Data from the Institute of Supply Chain Management’s monthly business outlook surveys corroborate the continued uncertainty in the business environment. Some notable replies from the May ISM surveys included:

Manufacturing survey:

Services survey:

Our opinion is that the sooner Trump can put tariff rhetoric to bed, the better, especially as we approach July 9, the end date for the 90-day tariff pause/reductions. After this date, country-specific tariffs of up to 50% are supposed to be reinstated (WhiteHouse.gov), with many emerging market economies facing the highest potential tariff rates. It’s our opinion that Trump will either extend the current tariff pause or only implement a greatly reduced tariff schedule so as not to spook markets again. On balance, this could be positive for the long-term performance of markets and the economy and could be a good step toward rebuilding business confidence.

War in the Middle East & Market Impacts

Beyond tariffs, markets are focused on other geopolitical risks, namely the evolving conflict between Israel and Iran. Initially, it looked as if fighting would be confined between Israel and Iran, but then the US jumped in and bombed several uranium refinement facilities. Russia and China, which are Iran’s most powerful allies, have thus far condemned the attack but urged peace and have not indicated a willingness to send in their own militaries to intervene.

The threat of further escalation currently appears diminished, and a sustainable ceasefire may be possible, but many are still asking what would happen to markets if events took an unexpected turn for the worse and a larger war (proxy or otherwise) broke out. If history is any guide, the market reaction could be muted beyond the short term. The chart below, courtesy of First Trust, illustrates the performance of the S&P 500 from 1928 through February 2022, with dates of significant wars highlighted throughout.

Source: First Trust

Some wars were followed by market rallies, while others were followed by declines. This leads us to the opinion that prevailing economic and market conditions prior to a war often supersede the conflict itself. For instance, the Iraq War started in 2003 just as the early 2000s recession was ending. Stocks were beaten down and undervalued, and interest rates were at 50-year lows thanks to an accommodative Federal Reserve. Sure, there was some short-term volatility as the war started, but the market ultimately rallied over the next several years. How much did the start of the Iraq War have to do with the initiation of the 2003–2007 multiyear bull market? Probably not much.

Fast-forward to now, and the economy is still growing, unemployment is low, and Congress is trying to pass fiscal stimulus. That suggests that escalation of the current conflict could temporarily stir up equity and oil markets, but the impacts will likely fall far short of quenching the bull market and economic expansion.

Final Thoughts – What We’re Watching for in Q3

Current economic and market data suggest an optimistic outlook for investments through the second half of 2025. The economy is normalizing, although there is always a risk that trade wars will heat up again. At the same time, inflation continues to trend lower towards the Fed’s long-term 2% target (Bureau of Labor Statistics), leading us to believe that short-term interest rates will be cut in September. Futures markets and the Fed’s own projections are implying there will be a second rate cut prior to year-end, most likely in December (CME Group).

Indicators we’ll be especially watching include business confidence data and statistics on the health of the labor market. Job openings are gradually falling, and weekly claims for unemployment benefits are edging higher. This doesn’t concern us so long as conditions do not rapidly deteriorate, as the Federal Reserve is still trying to bring the labor market into better balance.

Source: Federal Reserve

On a very near-term basis, the S&P 500 is approaching its February all-time high at 6,144 (yCharts). At the same time, the percentage of individual stocks in short-term uptrends is decreasing, indicating selective strength in recent rallies (StockCharts). These conditions often lead to short-term market pullbacks, so gains may pause over the coming weeks. Regardless, we are positive on stocks and the economy over the longer term, so any minor dip should likely be viewed as a buying opportunity.

As always, we are grateful for the opportunity to serve you in your wealth-building journey, and on behalf of Union Bridge Capital, we wish you a wonderful summer.

Join Our Mailing List