Our firm’s principal often quips that investments are the only thing that people like to buy when they’re more expensive and don’t like to buy when they’re cheap. Over the last several weeks, we have watched different types of assets decline in value, moving from relatively expensive to relatively cheap. As some asset classes continue to show signs of becoming undervalued while the market sinks, we expect buying opportunities to begin presenting themselves and are preparing to take advantage of them.

A Reminder That Bonds Can Lose Value Too

One of the biggest surprises to many in the market sell-off is that many bonds, bond funds, and bond ETFs have declined in value. Bonds usually move up or down due to fluctuations in interest rates, but they are also sensitive to changes in the economy. When a corporation issues a bond, it is borrowing money. If the economic conditions indicate that corporations are becoming less profitable, investors will become concerned that the corporation may not be able to pay its bond holders back and will therefore look to sell these bonds, driving down their value. The industry’s term for this is “credit risk.”

Different bonds incur different degrees of credit risk. U.S. Treasury bonds have no credit risk, as the U.S. government can simply print dollars if it needs to. Therefore, they are the ultimate safe haven in times of economic distress. On the opposite end of the spectrum are high-yield (or junk bonds). In the middle lie bonds from large, well-established corporations such as Apple, Honeywell, and Verizon. Even municipal bonds, which are backed by city and local governments, often have a little bit of credit risk.

Over the last eight weeks, nearly every bond that has any credit risk has fallen in value.

Credit Risk Means Reverts – That’s an Opportunity

In the stock market, we often talk about over- and undervaluation. We think about Warren Buffet creating his fortune by buying stocks during the multiple recessions in the 1970s. Value investing works with stocks since valuations are mean-reverting – that is, we have steady anchors to determine whether to buy or sell, whether we look at price/earnings, price/book, or price/sales ratios. Similarly, credit risk is also mean-reverting, indicating that we can determine whether bonds are over- or undervalued.

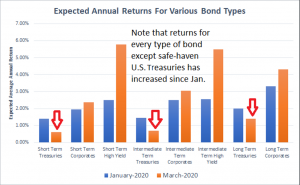

Unsurprisingly, bonds that have credit risk are becoming quite undervalued with the recent sell-off. Our internal expected return bond models in house are designed to allow us to forecast the average annual returns over a ten-year period.

In January, our models indicated we should not own a significant number of credit-risky bonds. Therefore, we cut our holdings significantly before the sell-off. Now, in March, while everyone else is selling them, a case for owning more of them may be starting to emerge.

A Quick Note on Stocks

There has been a similar phenomenon with stocks as there has been with credit-risky bonds. For instance, in January, our internal modeling forecasted the S&P 500 returning 5.12% per year over the next decade. This return is well below the historical average. Now, because of valuations, the expected average annual return over the next ten years has increased to 8.56%. That amounts to a cumulative increase in our total return forecast for domestic stocks of over 40% through 2030. The expected returns for international and emerging market stocks have similarly jumped across the board.

The Bluntest of Blunt Instruments – You Can’t Use Valuations for Precise Timing

Please visit the website of our institutional money management arm, Cantilever Wealth Management, LLC, for a further discussion on this topic. Investing using valuation is most appropriate for long-term time horizons and is not precise for exact timing. For example, stocks, bonds with credit risk, and real estate were all undervalued for several months before the market bottomed in March 2009, and many investors bought stocks too early and found themselves facing big losses. For this reason, we use valuations to tell us what looks attractive to purchase over a long time horizon while using technical and quantitative analysis to tell us exactly when to buy. Valuations are akin to coarse adjustments, while technical and quantitative analysis are more like fine-tuning. Finally, to drill the point home, if you can forgive me for using two clichés in one sentence, we want to “buy when there is blood in the streets,” but we want to make sure we don’t get cut “catching a falling knife.” In fact, we may still wind up reducing our exposure to some stocks and bonds before we find the ideal point to begin increasing our risk exposure.

In summary, we understand that the extreme recent market volatility has been enough to make most investors uneasy. No one likes to see large short-term declines in their portfolios, but the key to long-term successful investing is to realize that with turbulence comes opportunity. As these opportunities become more apparent, we plan on making selective portfolio adjustments to enhance the potential for increased wealth over the long run.

– Christopher Diodato, CFA®, CMT

Senior Portfolio Manager

Just as Risky Assets Start Becoming Attractive, Nobody Wants Them

Our firm’s principal often quips that investments are the only thing that people like to buy when they’re more expensive and don’t like to buy when they’re cheap. Over the last several weeks, we have watched different types of assets decline in value, moving from relatively expensive to relatively cheap. As some asset classes continue to show signs of becoming undervalued while the market sinks, we expect buying opportunities to begin presenting themselves and are preparing to take advantage of them.

A Reminder That Bonds Can Lose Value Too

One of the biggest surprises to many in the market sell-off is that many bonds, bond funds, and bond ETFs have declined in value. Bonds usually move up or down due to fluctuations in interest rates, but they are also sensitive to changes in the economy. When a corporation issues a bond, it is borrowing money. If the economic conditions indicate that corporations are becoming less profitable, investors will become concerned that the corporation may not be able to pay its bond holders back and will therefore look to sell these bonds, driving down their value. The industry’s term for this is “credit risk.”

Different bonds incur different degrees of credit risk. U.S. Treasury bonds have no credit risk, as the U.S. government can simply print dollars if it needs to. Therefore, they are the ultimate safe haven in times of economic distress. On the opposite end of the spectrum are high-yield (or junk bonds). In the middle lie bonds from large, well-established corporations such as Apple, Honeywell, and Verizon. Even municipal bonds, which are backed by city and local governments, often have a little bit of credit risk.

Over the last eight weeks, nearly every bond that has any credit risk has fallen in value.

Credit Risk Means Reverts – That’s an Opportunity

In the stock market, we often talk about over- and undervaluation. We think about Warren Buffet creating his fortune by buying stocks during the multiple recessions in the 1970s. Value investing works with stocks since valuations are mean-reverting – that is, we have steady anchors to determine whether to buy or sell, whether we look at price/earnings, price/book, or price/sales ratios. Similarly, credit risk is also mean-reverting, indicating that we can determine whether bonds are over- or undervalued.

Unsurprisingly, bonds that have credit risk are becoming quite undervalued with the recent sell-off. Our internal expected return bond models in house are designed to allow us to forecast the average annual returns over a ten-year period.

In January, our models indicated we should not own a significant number of credit-risky bonds. Therefore, we cut our holdings significantly before the sell-off. Now, in March, while everyone else is selling them, a case for owning more of them may be starting to emerge.

A Quick Note on Stocks

There has been a similar phenomenon with stocks as there has been with credit-risky bonds. For instance, in January, our internal modeling forecasted the S&P 500 returning 5.12% per year over the next decade. This return is well below the historical average. Now, because of valuations, the expected average annual return over the next ten years has increased to 8.56%. That amounts to a cumulative increase in our total return forecast for domestic stocks of over 40% through 2030. The expected returns for international and emerging market stocks have similarly jumped across the board.

The Bluntest of Blunt Instruments – You Can’t Use Valuations for Precise Timing

Please visit the website of our institutional money management arm, Cantilever Wealth Management, LLC, for a further discussion on this topic. Investing using valuation is most appropriate for long-term time horizons and is not precise for exact timing. For example, stocks, bonds with credit risk, and real estate were all undervalued for several months before the market bottomed in March 2009, and many investors bought stocks too early and found themselves facing big losses. For this reason, we use valuations to tell us what looks attractive to purchase over a long time horizon while using technical and quantitative analysis to tell us exactly when to buy. Valuations are akin to coarse adjustments, while technical and quantitative analysis are more like fine-tuning. Finally, to drill the point home, if you can forgive me for using two clichés in one sentence, we want to “buy when there is blood in the streets,” but we want to make sure we don’t get cut “catching a falling knife.” In fact, we may still wind up reducing our exposure to some stocks and bonds before we find the ideal point to begin increasing our risk exposure.

In summary, we understand that the extreme recent market volatility has been enough to make most investors uneasy. No one likes to see large short-term declines in their portfolios, but the key to long-term successful investing is to realize that with turbulence comes opportunity. As these opportunities become more apparent, we plan on making selective portfolio adjustments to enhance the potential for increased wealth over the long run.

– Christopher Diodato, CFA®, CMT

Senior Portfolio Manager

Join Our Mailing List