First Quarter Commentary: Stocks Drop With Trump 2.0 at the Helm

After rallying through January and the first half of February, stocks stumbled, with the S&P 500 dropping 10% from its bull market peak, entering its first official “correction” since October 2023. The big-cap “Magnificent 7” stocks (Apple, Microsoft, NVIDIA, Alphabet, Amazon, Meta, and Tesla) led markets lower with all but Meta posting double-digit losses from January through March. International stocks have fared significantly better, with the MSCI Europe, Asia, and Far East (EAFE) Index outperforming the S&P 500 by 10.7% year-to-date at the end of the first quarter (yCharts).

New Policies Knocking – Making Sense of Potential Economic Forces in Trump 2.0’s Agenda

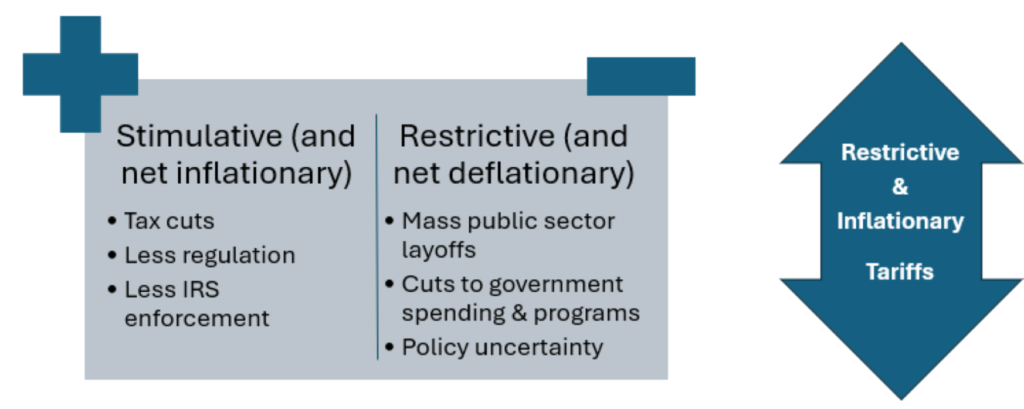

Much of the recent market volatility has been centered around the new administration and what laws and executive orders will be signed this year. Indeed, the Trump team has provided markets with a potpourri of initiatives and proposals which could heavily influence future economic growth and inflation. On the economic side, deficit-funded tax cuts, reduced regulation, and budget cuts for IRS enforcement should stimulate economic growth. It is important to note that any measure that stimulates the economy has the potential to cause inflation. On the other hand, large cuts to government spending and mass layoffs in the public sector can result in a net cooling of economic growth, potentially causing disinflation (lower inflation) or even deflation.

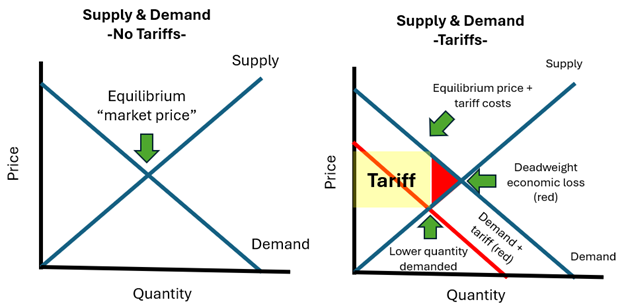

Tariffs are in their own category, as they are both inflationary (at least at first) and restrictive on economic growth. We view tariffs and the propensity of businesses to pass costs to consumers as, in effect, a national sales tax on consumption, much like the European “Value-Added Tax (VAT).” A consumption tax skews the natural balance of supply and demand for goods by artificially inflating prices above their “equilibrium market price,” which is where demand and supply are perfectly matched. The net effect is lower demand for goods and services, with governments gaining some tax revenue. The amount of revenue gained is not equal to what is lost from consumer spending, resulting in a net “deadweight loss” on economic growth. Deadweight losses across an economy are especially harsh when a good targeted by a tariff is non-discretionary and has few substitutes. Energy and agricultural products are examples of such goods.

The graphs below illustrate the impact on supply, demand, and general economic growth with the presence of tariffs, which we are treating as a broad-based tax on consumption. If you took economics courses in high school or college, these should look familiar.

Potentially just as impactful as tariffs is the uncertainty surrounding overall policy. For example, the latest survey from the Institute of Supply Chain Management indicated that businesses are holding off on hiring, expanding, and creating new orders. The enactment of tariffs followed by immediate reversals and new threats is contributing to the uncertainty. This can place further strain on broad economic growth as businesses and consumers sit on their hands and wait for more concrete policies.

Our Take on Economic Headwinds and Tailwinds

We are finishing the first quarter of 2025 with the economy trotting along, at least for the time being. Inflation is also continuing to drift lower thanks to Federal Reserve policy and easing geopolitical tensions (i.e., lower oil prices), reaching an annualized 2.8% as of the February release of the Consumer Price Index. Of course, this may change due to tariff policies, but as of now, inflation is trending in the right direction.

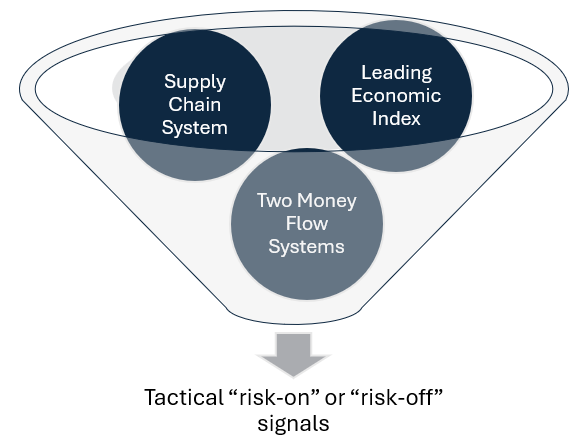

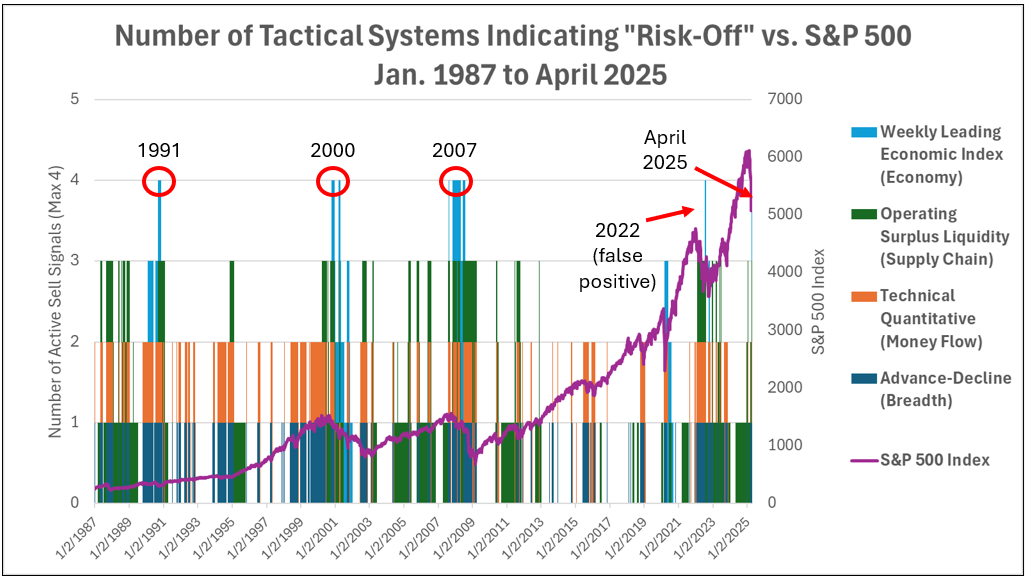

Whether the economy can withstand the impacts of restrictive government policies remains to be seen. Our outlook suggests a degree of caution, as our four proprietary tactical systems used to identify turns in market cycles are weakening to the point of triggering broad risk-off signals for portfolios.

As investment managers dedicated to empiricism, we take these signals as an initial indication to take current changes in the economic and market environment seriously. We are currently running calculations and preparing to reduce exposure to the most economically sensitive stocks and bonds within portfolios. We are also adding a modest allocation to gold to help enhance diversification during this volatile time.

Hedging the Risks of Potential Bearish Forces

The S&P 500 dropped by 10% from its most recent high during the first quarter, qualifying as a market “correction.” Most corrections have historically not been followed by bear markets. In fact, research by UBS indicates that out of the 40 10% corrections during bull markets going back to 1943, only 12 (30%) turned into full-fledged bear markets.

Those are just historical odds, but our backtested research shows the odds are higher when our four proprietary tactical systems are flagging weakness. The presence of four active signals of weakness is also historically associated with lower future expected returns for stocks.

Results are backtested and hypothetical. The first iteration of our four-signal tactical system was launched as a decision-making tool in 2018. The latest version, which includes our proprietary Leading Economic Index, was deployed in 2023. Past performance does not guarantee future results. Sources: yCharts, Wall Street Journal

We view our anticipated portfolio adjustments, which include a reduction of about 12%–17% in any given equity allocation, as a risk-reduction measure in response to developing economic and market weakness. There are two primary reasons we chose this percentage. First, any “tactical” investment decision is of secondary importance to a portfolio’s primary goal – staying invested for long-term growth. Second, tactical asset allocation decisions are always subject to a risk of false positives, especially over the short term. For example, a single Truth Social post could change the tariff regime yet again and cause markets to rally.

Our mantra for these portfolio changes will be to be “correct big” or “wrong small,” meaning that we will be ready to adapt if data pertaining to lending markets, supply chains, business sentiment, and money flows into stocks rapidly improves. But, for now, the burden of proof is on the bulls, and a degree of caution is warranted.

Final Thoughts – Markets & Economies Rarely Move in a Straight Line

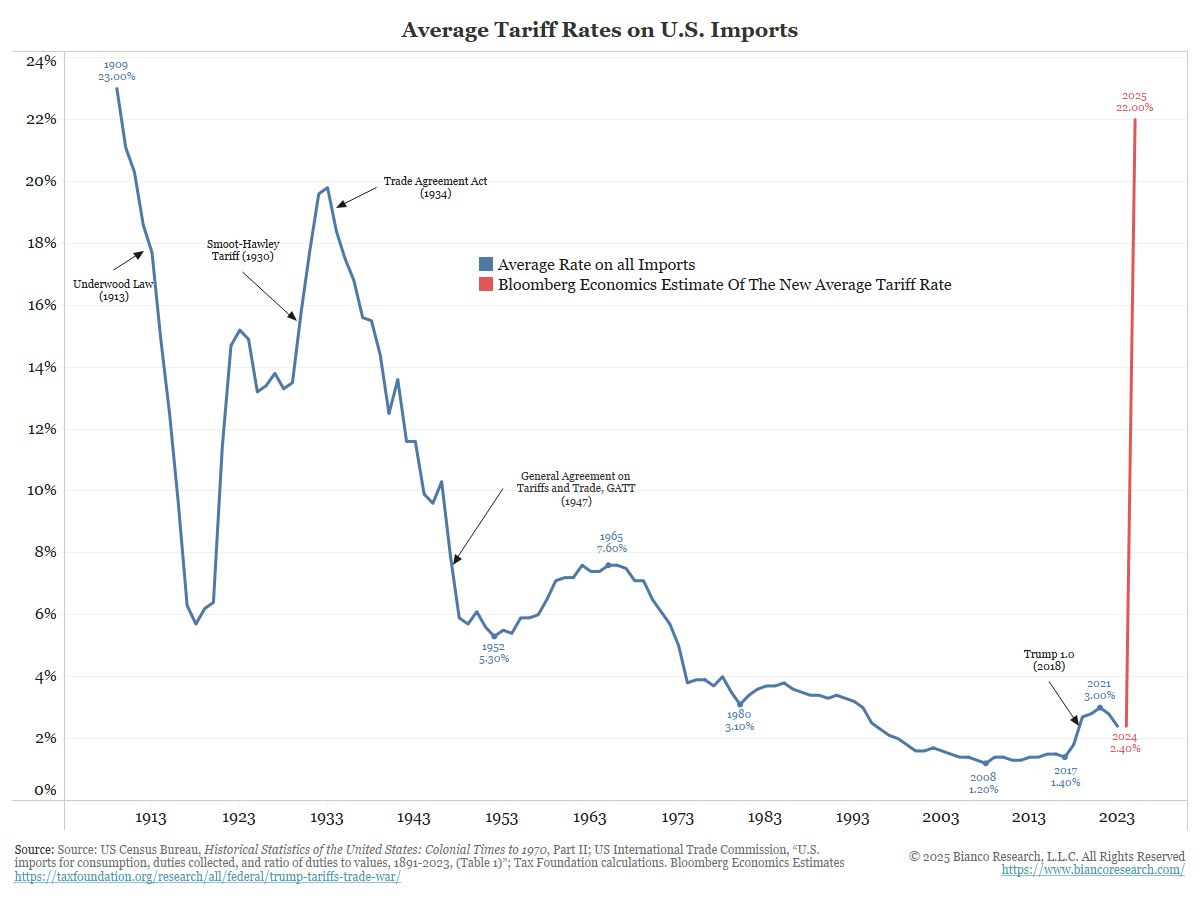

The potpourri of anticipated stimulus coming from tax cuts and decreased regulation will not, in our opinion, be enough to offset the estimated hike in the effective US tariff rate on imports from 2.40% in 2024 to 22.0% (according to Bloomberg estimates).

Government layoffs will be a further dampener on the economy, but since workers on severance are typically not counted in labor market data, these may not show up in unemployment statistics until later this year.

Guided by our time-tested research and algorithms, we are making moves to reduce the aggressiveness of portfolios as probabilities tilt closer future economic and market weakness. Should the data change, positively or negatively, we will be ready to adapt quickly and efficiently to deliver the optimal outcomes for our investment strategies and clients.

First Quarter 2025 Commentary

First Quarter Commentary: Stocks Drop With Trump 2.0 at the Helm

After rallying through January and the first half of February, stocks stumbled, with the S&P 500 dropping 10% from its bull market peak, entering its first official “correction” since October 2023. The big-cap “Magnificent 7” stocks (Apple, Microsoft, NVIDIA, Alphabet, Amazon, Meta, and Tesla) led markets lower with all but Meta posting double-digit losses from January through March. International stocks have fared significantly better, with the MSCI Europe, Asia, and Far East (EAFE) Index outperforming the S&P 500 by 10.7% year-to-date at the end of the first quarter (yCharts).

New Policies Knocking – Making Sense of Potential Economic Forces in Trump 2.0’s Agenda

Much of the recent market volatility has been centered around the new administration and what laws and executive orders will be signed this year. Indeed, the Trump team has provided markets with a potpourri of initiatives and proposals which could heavily influence future economic growth and inflation. On the economic side, deficit-funded tax cuts, reduced regulation, and budget cuts for IRS enforcement should stimulate economic growth. It is important to note that any measure that stimulates the economy has the potential to cause inflation. On the other hand, large cuts to government spending and mass layoffs in the public sector can result in a net cooling of economic growth, potentially causing disinflation (lower inflation) or even deflation.

Tariffs are in their own category, as they are both inflationary (at least at first) and restrictive on economic growth. We view tariffs and the propensity of businesses to pass costs to consumers as, in effect, a national sales tax on consumption, much like the European “Value-Added Tax (VAT).” A consumption tax skews the natural balance of supply and demand for goods by artificially inflating prices above their “equilibrium market price,” which is where demand and supply are perfectly matched. The net effect is lower demand for goods and services, with governments gaining some tax revenue. The amount of revenue gained is not equal to what is lost from consumer spending, resulting in a net “deadweight loss” on economic growth. Deadweight losses across an economy are especially harsh when a good targeted by a tariff is non-discretionary and has few substitutes. Energy and agricultural products are examples of such goods.

The graphs below illustrate the impact on supply, demand, and general economic growth with the presence of tariffs, which we are treating as a broad-based tax on consumption. If you took economics courses in high school or college, these should look familiar.

Potentially just as impactful as tariffs is the uncertainty surrounding overall policy. For example, the latest survey from the Institute of Supply Chain Management indicated that businesses are holding off on hiring, expanding, and creating new orders. The enactment of tariffs followed by immediate reversals and new threats is contributing to the uncertainty. This can place further strain on broad economic growth as businesses and consumers sit on their hands and wait for more concrete policies.

Our Take on Economic Headwinds and Tailwinds

We are finishing the first quarter of 2025 with the economy trotting along, at least for the time being. Inflation is also continuing to drift lower thanks to Federal Reserve policy and easing geopolitical tensions (i.e., lower oil prices), reaching an annualized 2.8% as of the February release of the Consumer Price Index. Of course, this may change due to tariff policies, but as of now, inflation is trending in the right direction.

Whether the economy can withstand the impacts of restrictive government policies remains to be seen. Our outlook suggests a degree of caution, as our four proprietary tactical systems used to identify turns in market cycles are weakening to the point of triggering broad risk-off signals for portfolios.

As investment managers dedicated to empiricism, we take these signals as an initial indication to take current changes in the economic and market environment seriously. We are currently running calculations and preparing to reduce exposure to the most economically sensitive stocks and bonds within portfolios. We are also adding a modest allocation to gold to help enhance diversification during this volatile time.

Hedging the Risks of Potential Bearish Forces

The S&P 500 dropped by 10% from its most recent high during the first quarter, qualifying as a market “correction.” Most corrections have historically not been followed by bear markets. In fact, research by UBS indicates that out of the 40 10% corrections during bull markets going back to 1943, only 12 (30%) turned into full-fledged bear markets.

Those are just historical odds, but our backtested research shows the odds are higher when our four proprietary tactical systems are flagging weakness. The presence of four active signals of weakness is also historically associated with lower future expected returns for stocks.

Results are backtested and hypothetical. The first iteration of our four-signal tactical system was launched as a decision-making tool in 2018. The latest version, which includes our proprietary Leading Economic Index, was deployed in 2023. Past performance does not guarantee future results. Sources: yCharts, Wall Street Journal

We view our anticipated portfolio adjustments, which include a reduction of about 12%–17% in any given equity allocation, as a risk-reduction measure in response to developing economic and market weakness. There are two primary reasons we chose this percentage. First, any “tactical” investment decision is of secondary importance to a portfolio’s primary goal – staying invested for long-term growth. Second, tactical asset allocation decisions are always subject to a risk of false positives, especially over the short term. For example, a single Truth Social post could change the tariff regime yet again and cause markets to rally.

Our mantra for these portfolio changes will be to be “correct big” or “wrong small,” meaning that we will be ready to adapt if data pertaining to lending markets, supply chains, business sentiment, and money flows into stocks rapidly improves. But, for now, the burden of proof is on the bulls, and a degree of caution is warranted.

Final Thoughts – Markets & Economies Rarely Move in a Straight Line

The potpourri of anticipated stimulus coming from tax cuts and decreased regulation will not, in our opinion, be enough to offset the estimated hike in the effective US tariff rate on imports from 2.40% in 2024 to 22.0% (according to Bloomberg estimates).

Government layoffs will be a further dampener on the economy, but since workers on severance are typically not counted in labor market data, these may not show up in unemployment statistics until later this year.

Guided by our time-tested research and algorithms, we are making moves to reduce the aggressiveness of portfolios as probabilities tilt closer future economic and market weakness. Should the data change, positively or negatively, we will be ready to adapt quickly and efficiently to deliver the optimal outcomes for our investment strategies and clients.

Join Our Mailing List